- Home

- UpFront

- Take One: Big story of the day

- Vijay Shekhar Sharma was once the poster boy of India's fintech revolution. Now it all seems to be crashing down

Vijay Shekhar Sharma was once the poster boy of India's fintech revolution. Now it all seems to be crashing down

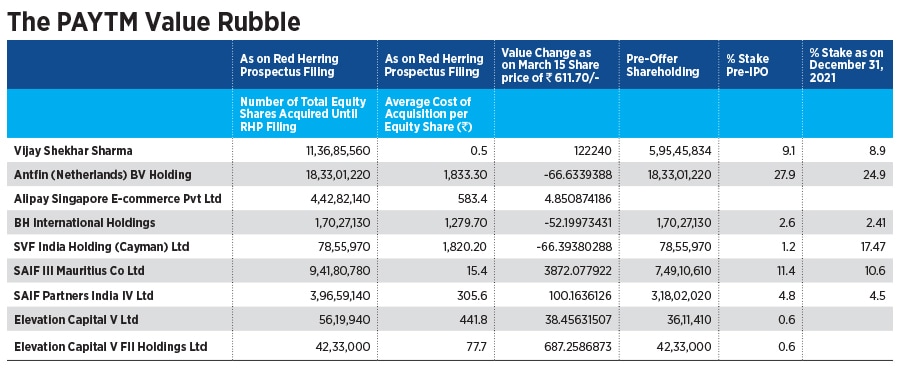

Since its fateful listing last year, Paytm's shares have tanked some 68 percent, eroding shareholder wealth significantly. On March 14, the stock took a further beating when it tanked 12 percent immediately after the RBI raised concerns about Paytm's payments bank

Vijay Shekhar Sharma, founder, Paytm Image: Dhiraj Singh/Bloomberg via Getty Images

Vijay Shekhar Sharma, founder, Paytm Image: Dhiraj Singh/Bloomberg via Getty Images

It’s been a few turbulent months for Vijay Shekhar Sharma and his 12-year-old company, Paytm. And there seems to be no respite from the troubles.

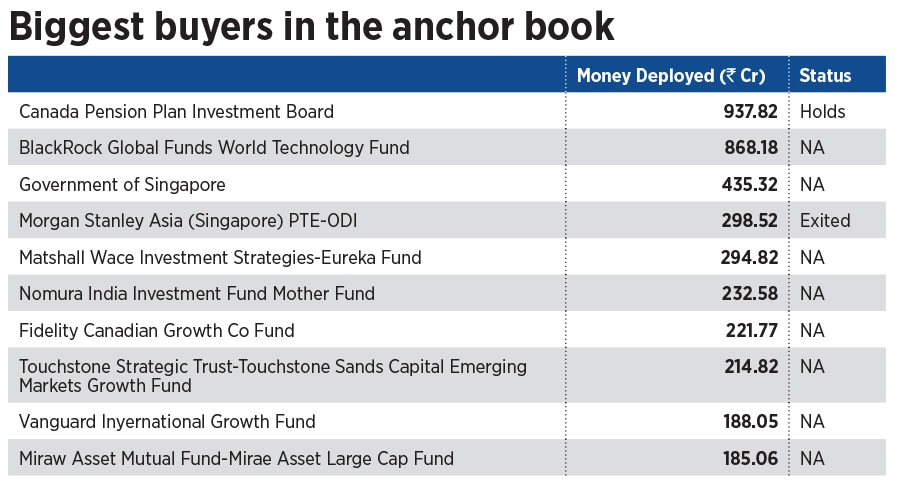

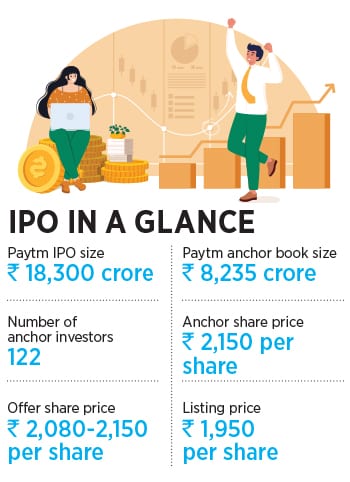

It all started last November, with Paytm’s long-anticipated IPO, seeking to raise as much as $2.5 billion to fund expansion plans. The fintech behemoth had been a unicorn since 2015 and was last valued at a staggering $16 billion before it decided to go public. Through the IPO, Paytm was seeking a valuation of $20 billion.

Related stories

The plan seemed firmly on track, especially since the IPO was fully subscribed. While the retail part was subscribed 1.7 times, the institutional part was subscribed 2.8 times. Just months earlier, Zomato, another poster boy of India’s thriving startup ecosystem, had a stellar listing on the bourses, listing at a 53 percent premium on its final offer price. Even Nykaa, the cosmetic and beauty e-commerce company had an exceptional listing on the bourses, barely a week before Paytm’s listing, valuing the company at some $13 billion. Clearly, the stock markets were loving India’s new-age startups.

For Paytm, however, the bourses proved ruthless. Hours before its public listing on November 18, a damning report from Sydney-headquartered Macquarie Research raised serious eyebrows about Paytm’s future, sending its share prices into a downward spiral once it listed.

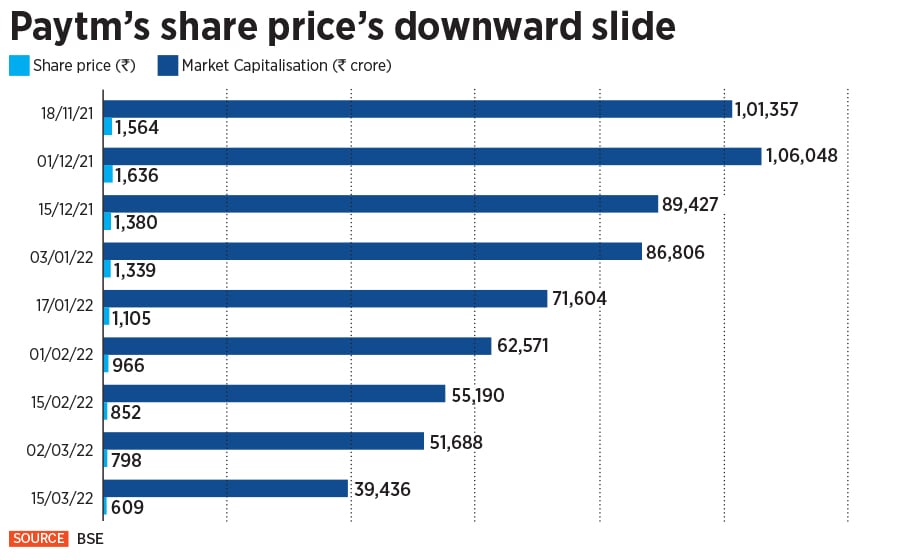

On November 18, the listing day, the stock hit a lower circuit of 20 percent, half an hour before closing bell, sliding 27.25 percent from its issue price of Rs 2,150 to Rs 1,564.15. The market capitalisation stood at Rs 1.01 lakh crore ($13.5 billion) well below its IPO valuation of Rs 1.5 lakh crore ($20 billion).

“Dabbling in multiple business lines inhibits Paytm from being a category leader in any business except wallets, which are becoming inconsequential with the meteoric rise in UPI payments,” Macquarie Research said in its report. “Competition and regulation will drive down unit economics and/or growth prospects in the medium term in our view.”

Since that fateful listing, Paytm’s shares have tanked some 68 percent, eroding shareholder wealth significantly, while India’s benchmark index, Sensex has only seen a 5.8 percent decline during the same five months. The decline in Sensex has been largely due to the ongoing crisis in Ukraine.

Then, on March 14, the stock took a further beating when it tanked 12 percent immediately after the Reserve Bank of India (RBI) raised concerns about Paytm’s payments bank. On March 11, it said that the company’s payments bank cannot take on new customers until it receives clearance from the central bank, following an IT audit. As of March 15, Paytm’s share price has fallen a further 8 percent to Rs 618.

“The Reserve Bank of India has today, in exercise of its powers, inter alia, under section 35A of the Banking Regulation Act, 1949, directed Paytm Payments Bank Ltd to stop, with immediate effect, onboarding of new customers,” said the RBI in a statement. “The bank has also been directed to appoint an IT audit firm to conduct a comprehensive System Audit of its IT system. Onboarding of new customers by Paytm Payments Bank Ltd will be subject to specific permission to be granted by RBI after reviewing report of the IT auditors. This action is based on certain material supervisory concerns observed in the bank.”

While it’s still unclear as to why the RBI has raised concerns about Paytm’s payments business, a report by Bloomberg suggested that the company had allowed data to flow to servers abroad and didn’t properly verify its customers. Paytm has denied the allegation.

“The company would like to update that it has been informed by its associate, Paytm Payments Bank Limited (PPBL), that the regulator has not expressed any concerns regarding data leak or access shared with any Chinese firms,” Paytm told Forbes India in an email. “PPBL’s data servers are located within India, and it proudly supports data localisation. The Reserve Bank of India (RBI) directive to PPBL to temporarily halt onboarding of new customers, via a letter dated March 11, 2022, is not regarding any data leak to any foreign national or firms. PPBL remains committed to working with the regulator to address their concerns as quickly as possible.”

The regulatory hurdle, meanwhile, extends some serious concerns that investors would have on profitability and scalability of the Noida-headquartered fintech firm that Vijay Shekhar Sharma founded in 2010.

The company is without doubt, India’s most recognised fintech player, even as many new players have joined the fray in the past few years. Over the past decade, it had also grown into a household name, thanks to its advertising blitzkrieg in the aftermath of India’s controversial demonetisation exercise, when the Indian government demonetised 86 percent of the country’s high-value currency in November 2016.

Payments Bank: Formidable, but not profitable

Paytm commenced its payments banking operations on May 23, 2017, becoming the only one among a bunch of mobile wallet companies to get such a license. It created for them the platform to scout for more customers who could transact and deposit their funds with the organisation. But a payments bank cannot—as other commercial banks can—lend directly from the deposits parked with it, as per RBI norms, or carry out credit card transactions. So, they tie up with banks and non-banking financial companies (NBFCs) to source and process loans.

Paytm had created a new platform called Paytm Lending on its mobile app, which it claims processed loans in less than 2 minutes. Paytm Payments Bank Ltd (PPBL) is a formidable player, compared to other payments banks such as Airtel Payments Bank, Fino Payments Bank, Indian Post Payments Bank, and Jio Payments Bank.

PPBL reported revenues of Rs 1,987.4 crore in FY21, down nearly 6 percent from FY20’s figure of Rs 2,110.6 crore. PPBL had 65 million accounts, as of June 2021, and Rs 5,200 crore in deposits. The number of loans disbursed through Paytm was 4.4 million, valued at Rs 2,181 crore, for the quarter ended December 2021, both showing a 401 percent and 366 percent jump from a year earlier, but on a very low base of December 2021. Airtel Payments Bank had reportedly touched Rs 1,000 crore on an annual basis, the company had said in August 2021. One 97 communication owns 49 percent of PBBL, with Vijay Shekhar Sharma holding the balance.

Much of the payments landscape has changed since Paytm and Airtel launched their financial services. But the success of UPI in the payments landscape has made it almost impossible for payments banks and payment gateways to make substantial profits. Paytm’s losses have widened to Rs 778 crore as of December 31, 2021, compared to Rs 537 crore a year earlier.

“The RBI has been pro-consumer and pro-innovation; the onus is on fintech and payment companies to emerge profitable. Payment banks can be profitable if they are not chasing hyper-growth at the expense of unit economics, which is otherwise probably necessary to raise more capital,” says Rishi Jhunjhunwala, senior vice president and lead analyst, technology, at IIFL Institutional Equities. “Paytm, which has already raised enough capital, needs to focus on the path to profitability.”

“The RBI has been pro-consumer and pro-innovation; the onus is on fintech and payment companies to emerge profitable. Payment banks can be profitable if they are not chasing hyper-growth at the expense of unit economics, which is otherwise probably necessary to raise more capital,” says Rishi Jhunjhunwala, senior vice president and lead analyst, technology, at IIFL Institutional Equities. “Paytm, which has already raised enough capital, needs to focus on the path to profitability.”

It is difficult to assess when Paytm will be consistently profitable, which will hang as a negative from an investor perspective.

“In the past 12 months, Paytm’s average ticket size of loans has been consistently coming down and stands at sub-Rs5,000 levels,” Macquarie said in a report this January. “At this size, we don’t think it is doing many merchant loans and most of the loans are small value BNPL loans. Hence the eventual distribution fees realised by them are likely to be much lower than our earlier estimates.”

"KYC for sure is not happening properly,” says Shriram Subramanian, founder and MD, InGovern. “Plus, there are media reports that Paytm is sharing data with China. Although Sharma has denied these allegations, we can't 100 percent believe him. So, we need one of the Big Fours to do a complete audit. But, for sure, I can tell you that KYC is not strong because there could be a possibility that one person has multiple accounts. KYC is completely lacking.”

All over the place

The recent troubles at Paytm seem to be just the tip of the iceberg.

“I think Vijay Shekhar Sharma has missed the bus when it comes to tapping the opportunity in the Indian fintech ecosystem,” says a senior financial sector expert, working closely with Paytm, on conditions of anonymity. “They had huge ambitions and wanted to foray into everything. But in the Indian market, you must focus on making yourself recognised for one or two key products and build your key business around that. That has been missing with Paytm. They are just all over the place.”

Paytm started as a platform for mobile recharge in 2010 with investments of $2 million from Sharma. Sharma, the son of a schoolteacher and a graduate of Delhi College of Engineering, soon added data cards, postpaid mobile and landline bill payments to the services Paytm offered in 2013. It was at a time when smartphones were slowly replacing feature phones in the country.

In October 2013, Sapphire Ventures invested $10 million and by 2014, the company expanded its portfolio to include a wallet, which became one of the most preferred modes of payment on ride-hailing app, Uber, and the Indian Railways. By 2015, it provided payment services for metro recharges, electricity, gas, and water bill payments, and had a user base of around 10.4 crore.

By 2015, the Jack Ma-led Alibaba Group invested in Paytm, signaling the Chinese e-commerce giant’s plan to aggressively ramp up its play in India at a time when India’s e-commerce business was beginning to grow rapidly. Ant Financial, which runs services such as the Alipay mobile wallet, took a 25 percent stake in One97 Communications in February 2015, in a transaction worth some $500 million. By September 2015, Alibaba directly had a 20 percent stake through a fresh issue of shares by investing about $680 million.

By 2015, the Jack Ma-led Alibaba Group invested in Paytm, signaling the Chinese e-commerce giant’s plan to aggressively ramp up its play in India at a time when India’s e-commerce business was beginning to grow rapidly. Ant Financial, which runs services such as the Alipay mobile wallet, took a 25 percent stake in One97 Communications in February 2015, in a transaction worth some $500 million. By September 2015, Alibaba directly had a 20 percent stake through a fresh issue of shares by investing about $680 million.

Paytm’s biggest shot in the arm came in November 2016, when the Indian government decided to demonetise high-value currency, giving a massive push towards online payments, and an impetus for the fintech revolution in India. In the early days of demonetisation, when people across the country were scrambling across ATMs to withdraw cash, Paytm even released full-page print ads congratulating the Prime Minister, with a wordplay on its tagline ‘Ab ATM Nahin, #Paytm Karo’.

Yet, less than a week into the demonetisation exercise, Paytm ran into trouble when a commercial it had launched following the monetary revamp was alleged to have hurt the sentiments of millions of Indians waiting for hours in long queues. With the tagline ‘Drama bandh karo… Paytm karo [Stop being melodramatic, use Paytm]’, the video showed a house-help asking her employer to stop being dramatic and instead use Paytm to pay her. Paytm immediately pulled down the advertisement after facing flak.

Even then, the company saw a 200 percent increase in downloads and a 10-fold increase in the addition of money in the wallet, right on the night of demonetisation.

Over the next few years, as India shifted more towards digital payments, Paytm was thriving, especially since it had already onboarded a large customer base and the platform had become a stronghold for UPI-based payments. It also helped that the company added a massive number of merchants on its platform, creating a captive business that swelled to some 140 million monthly users by 2019.

However, over the next few years, as more players entered the market, and interoperability for payments began to pick up, Paytm also began to lose its relevance. That was largely because incumbent players such as Paytm and PhonePe were using closed-loop QR codes, although UPI allowed them to be interoperable. Closed-loop QR codes only allowed transactions within one platform, while interoperability meant that users could move freely between platforms.

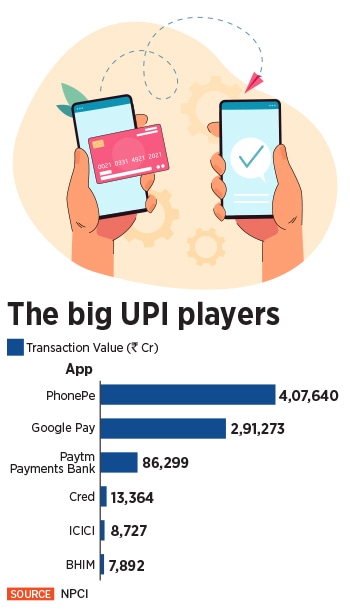

Today, the company lags far behind Walmart-led PhonePe and Google Pay in terms of UPI-based transactions. For instance, in February this year, on Phone Pe, transactions worth a staggering Rs 407,640 crore were carried out, while on Google pay, the number stood at Rs 291,273 crore. In contrast, across Paytm Payments Bank App, that number stood at Rs 86,299 crore.

Then, Paytm set up Paytm Mall, a competitor to Amazon and Flipkart. The company turned into a unicorn in 2018 after raising nearly half a billion dollars from SoftBank and others, and was valued at $2.86 billion in 2019 when it raised funding from eBay. But competing against the deep pockets of Amazon Walmart and even Reliance in India’s e-commerce market has meant that the business has largely become a damp squib.

The company’s other business forays over the past few years include the likes of Paytm Money, a platform for buying and selling stocks and other financial products, Paytm First Games, Paytm Financial Services, which sells insurance and gold, in addition to the payments bank. “They tried to emulate the China play,” says the financial sector expert quoted earlier. “But to do that, you need a monopoly. The Indian consumer will take the cash backs on offer and move to another place that provides the same.”

“Paytm has been a cash-burning machine, spinning off several business lines with no visibility on achieving profitability,” Macquarie had said in its report last November. “For large fintech, unless they have a closed-loop ecosystem and a captive customer base, building scale with profitability will remain a big challenge in our view.”

Paytm, meanwhile, seems unfazed, and believes it is on the right track. The company says that its lending business scaled to 4.1 million loan disbursals during the first two months of the quarter (year-on-year growth of 449 percent), with approximately 2.2 million loans disbursed in February 2022 alone. The company also says that its offline payments business has seen massive growth, with the number of devices deployed growing to 2.6 million.

“Paytm continues to lead in digital payments and financial services,” a spokesperson for Paytm told Forbes India. “In our recent filings, we have exhibited the growth we continue to achieve as a company. During the October-December quarter, the company saw its revenues jump by 89 percent y-o-y to Rs 1,456 crore, while the contribution profit for Q3 FY2022 at Rs 454 Cr represents a 560 percent y-o-y growth. As a company, we are absolutely clear and focussed on three line items—growth, revenue and profitability.”

That’s probably why the payments bank business seems crucial for the company’s plans, especially in its bid to evolve into a small finance bank (SFB) later. “Consumer and merchant loan distribution at best is only a $350 million revenue opportunity for Paytm in our view. Paytm must lend, ie, use its own balance sheet to make loans and do that profitably for which it needs a banking license, credit underwriting experience, and collection infrastructure, all of which are lacking at present in our view. Despite factoring in an aggressive 50 percent CAGR increase over the next five years in non-payment business revenues led by distribution business, we expect Paytm to generate positive free cash flow (FCF) only by FY30E.”

On the back burner

Up until now, Paytm had been the beneficiary of being able to execute a domestic growth story, being the first—among the several mobile wallets of previous years, such as MobiKwik, Naspers PayU, Freecharge—to get a payment banking license. The current regulatory overhang is unlikely to go away, only if it comes out clear from the audit. The small finance banking licence, which Paytm was likely to apply for later in 2022, is at least a year or more away now.

Though it is a leader as a payments bank, this model is no more a game-changer. For a customer, it may mean opening a savings account, depositing funds in it, and earning interest on it. But payments banks need to find alternatives to generate income. This can be done through effective cross-selling of financial products, which PPBL had been doing. With the SFB licence unlikely to come soon, it derails Sharma’s plans to become a lender to small businesses and the priority sector. After years, it will mean back to the drawing board.

Though it is a leader as a payments bank, this model is no more a game-changer. For a customer, it may mean opening a savings account, depositing funds in it, and earning interest on it. But payments banks need to find alternatives to generate income. This can be done through effective cross-selling of financial products, which PPBL had been doing. With the SFB licence unlikely to come soon, it derails Sharma’s plans to become a lender to small businesses and the priority sector. After years, it will mean back to the drawing board.

“We don't see a material financial impact due to this regulatory action. But they probably may not get a SFB licence until this issue is resolved and it is difficult to ascertain a timeline to it now,” says IIFL’s Jhunjhunwala. Paytm was seeing the SFB licence as a catalyst for growth. Also, none of India’s existing SFBs have emerged out of a payments bank, so Paytm’s transition to an SFB was going to be both unique and challenging.

Now, with the regulatory hurdles, it could mean a long road for Paytm’s payments bank business. Consider the case of HDFC Bank, a leader in the credit cards business, which in December 2020 was stopped by the RBI from launching its upcoming digital activities and source new credit card customers, after several technology outage disruptions. The ban to issue new credit cards was lifted after eight months and, only now in March 2022, has it been allowed to launch new digital activities.

There is conjecture on what the RBI has identified about PPBL’s operations or is concerned about. The RBI action, the regulator said, was based on “certain material supervisory concerns” observed in Paytm. “This could indicate that their internal controls were weak or could be some KYC lapses or due-diligence might not have been proper relating to some loan segments,” says an analyst with an equity brokerage firm, on condition of anonymity. He added that he did not believe the RBI action alluded to fraudulent activity. “The regulatory action specifically only stops Paytm from onboarding new customers. They have not banned the bank's current operations.”

The RBI will set the terms of reference for an independent systems audit of PPBL, though analysts say this may not be the first time. In the cases of PMC Bank and DHFL, independent auditors carried out forensic studies of their operations. In 2021, RBI governor Shaktikanta Das had pointed out the need to improve the depth and quality of audits in the banking system.

Paytm, meanwhile, said that the latest regulatory hurdle will not affect its existing customers. “The company would like to reiterate that this does not impact any existing customers of PPBL, who can continue to use all banking and payment services without interruption,” it said in a statement. “Users can not, until further notice, sign up for new PPBL wallets or PPBL savings or current accounts. Paytm believes that the measures imposed upon PPBL will not materially impact Paytm’s overall business.”

All that means it could take some time for Paytm’s payments bank business to return to normalcy. “Recent instances of embargo on a leading bank suggest lifting of restrictions may take time: Reference recent instances of embargo on a leading bank, it took 8 months to partially lift the restrictions and almost 15 months to wholly lift the same,” brokerage firm, ICICI Securities said in a report on March 14.

The troubled times for Vijay Shekhar Sharma and Paytm aren’t likely to go away anytime soon, by the looks of it. So, what’s the way out now for the poster boy of India’s fintech revolution? “I would think they need to consolidate their business with someone,” says the fintech expert, who has worked closely with Paytm. “Or, they sell their business as Freecharge has done in the past.”

With additional inputs from Neha Bothra